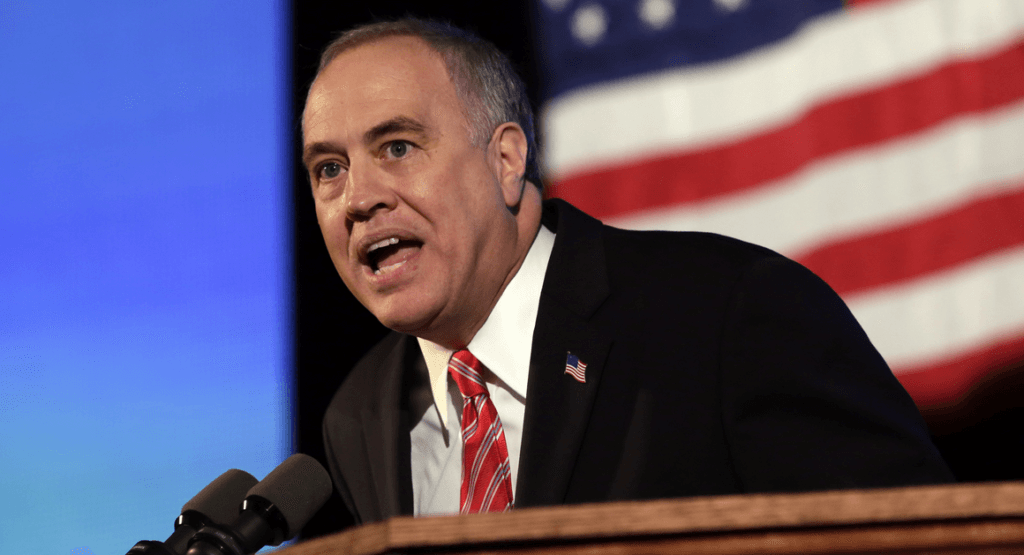

Photo courtesy of Politico

In a report recently released by Comptroller Tom DiNapoli, the unprecedented rise in unemployment during the pandemic is predicted to result in higher taxes for businesses to cover the cost for years to come. According to the report, the pandemic created a $9 billion deficit in New York state’s Unemployment Insurance Trust Fund.

In order to cover the $6.5 billion in unemployment claims to cover millions of New Yorkers who found themselves out of work, the state had to borrow from the federal government. According to DiNapoli, “the state currently owes Washington $9 billion and the obligation to pay back this money and rebuild the trust fund balance presents a serious challenge for the state and businesses struggling to recover from the pandemic.” As such, to pay it back, businesses will be on the hook to restock the fund through higher federal unemployment taxes so that the state does not dip into its own revenue. Of additional significance – DiNapoli cautions that unemployment tax rates in New York hit its highest level permissible under law, and it will only rise next year and in subsequent years if state or federal officials do not restock the fund.”

What else did the report find?

The report found that from the 4th quarter of 2019 to the 2nd quarter of 2020, unemployment benefits paid by New York increased from $530 million to $6.5 billion; this is a 1,124% increase. Making this increase even more difficult to overcome is the fact that New York’s unemployment fund was already less robust than in previous years, according to DiNapoli, standing at $2.6 billion less than the standard recommended by the U.S. Department of Labor. Given this foundation, the fund was depleted extremely quickly and now it has a negative balance that is double what was owed during the Great Recession.

The repercussions? The negative balance means that unemployment taxes on employers has increased to somewhere between 2.1-9.9% of taxable payroll; for reference, these rates were between 0.6-7.9% in 2020. As such, employers have seen an increase of anywhere between 26-160%, depending on their size, and this increase is likely to continue in 2022 and beyond if there remains a lack of state intervention, according to DiNapoli.

So what are some solutions?

While using federal stimulus money or even existing state revenue to help lower the deficit is a possibility, Governor Kathy Hochul and other state leaders have not indicated that this is an immediate solution. DiNapoli has proposed that state officials scope out if there are existing pandemic relief programs that could provide tax relief on employers. According to the National Conference of State Legislatures, 32 states will use some federal aid to both lower their unemployment fund deficits and limit the tax burden on companies. What is clear: action needs to be taken before this tax hike threatens to set back New York’s economic recovery.

Founded by attorneys Andreas Koutsoudakis and Michael Iakovou, KI Legal focuses on guiding companies and businesses throughout the entire legal spectrum as it relates to their business including day-to-day operations and compliance, litigation and transactional matters.

Connect with Andreas Koutsoudakis on LinkedIn.

Connect with Michael Iakovou on LinkedIn.

This information is the most up to date news available as of the date posted. Please be advised that any information posted on the KI Legal Blog or Social Channels is being supplied for informational purposes only and is subject to change at any time. For more information, and clarity surrounding your individual organization or current situation, contact a member of the KI Legal team, or fill out a new client intake form.

The post Comptroller DiNapoli Predicts Higher Taxes to Cover Unemployment Insurance Costs appeared first on KI Legal.