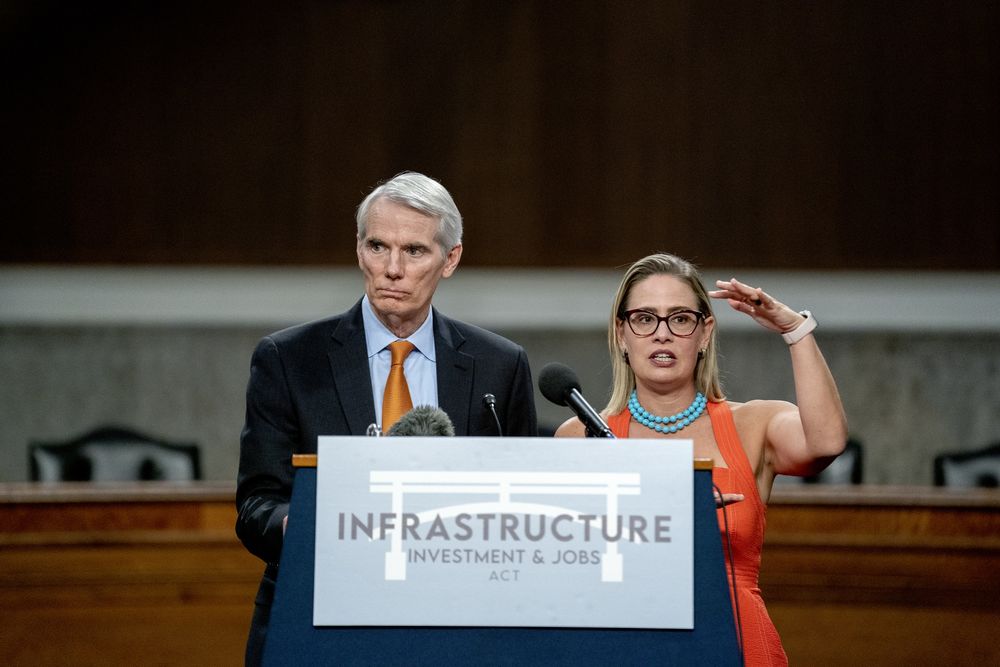

Should the $1 trillion Infrastructure Investment and Jobs Act pass, it will effectively end the pandemic-era tax break months earlier than expected – which can cause some serious damage for business owners.

What is the Employee Retention Tax Credit

The Employee Retention Tax Credit was created by the CARES Act in March of 2020. It was meant to incentivize employers to keep their employees on payroll in the face of the pandemic. Although it has been extended several times, the latest, which pushed it through the end of 2021, was set to be the last.

Credit Details

The refundable tax credit was made available to private-sector employers and tax-exempt organizations. According to the credit, these employers could then only qualify this year if their gross receipts fell by over 20% in a quarter relative to the same period in 2019. Additionally, businesses could still claim a 2020 credit if they amended their tax returns. Under its structure, qualifying businesses could get up to $7,000 per quarter, or $28,000 per employee in 2021.

What Does the Infrastructure Bill Change?

However, if the bill passes and thus ends the credit a quarter early, “this would effectively reduce the maximum credit available to employers from $28,000 to $21,000,” according to the Society for Human Resource Management’s legislative analysis. The only businesses exempt from this earlier cutoff are startup recovery businesses, which include any company that began operations after Feb. 15, 2020, that have average annual gross receipts of $1 million or less.

For lawmakers, however, cutting it early will allow “the federal government to save more than $8 billion, which is included in the funding arithmetic for the legislation,” according to the director of compliance at payroll and HR services firm Paychex Michael Trabold. This being said, Trabold and many others have pointed to the fact that perhaps the bill will not pass as quickly as lawmakers hope it will. House Speaker Nancy Pelosi, for example, has already stated that she will not take up the infrastructure bill until the Senate passes its sister $3.5 trillion soft infrastructure bill; ultimately, this will rest on turbulent Congress negotiations. Additionally, the co-founder and CEO of tax credit software Clarus R+D, Brent Johnson, has stated that “although the eligibility period for the credit would sunset on Oct. 1, 2021 if the infrastructure bill becomes law, the time frame for making a claim under the program would continue for at least three years thereafter.” Hopefully these statements will breathe a sigh of relief into struggling business owners, many of whom have only recently discovered the credit.

Founded by attorneys Andreas Koutsoudakis and Michael Iakovou, KI Legal focuses on guiding companies and businesses throughout the entire legal spectrum as it relates to their business including day-to-day operations and compliance, litigation and transactional matters.

Connect with Andreas Koutsoudakis on LinkedIn.

Connect with Michael Iakovou on LinkedIn.

This information is the most up to date news available as of the date posted. Please be advised that any information posted on the KI Legal Blog or Social Channels is being supplied for informational purposes only and is subject to change at any time. For more information, and clarity surrounding your individual organization or current situation, contact a member of the KI Legal team, or fill out a new client intake form.

The post The Infrastructure Bill’s Passing Will Initiate an Early End to the Employee Retention Tax Credit appeared first on KI Legal.